About Us

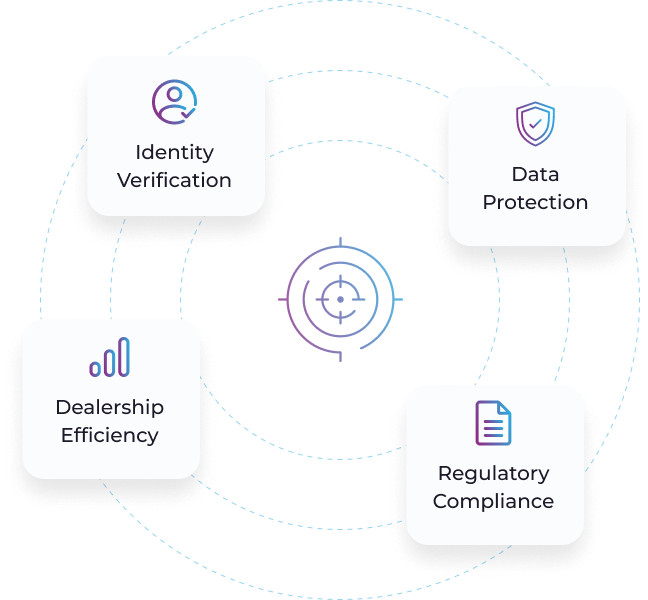

At Data Droplets Inc., we specialize in helping insurance agencies and auto dealerships protect sensitive customer data through tailored compliance solutions.

With a strong focus on Written Information Security Programs (WISPs), and customer date protection technology designed for regulatory alignment, we combine deep industry knowledge with a proactive approach to evolving federal and state data protection laws.

Focus Area: WISP

Written Information Security Program (WISP). Our technology solutions focus on ensuring compliance with federal and state regulations, requiring a WISP in protecting customers’ personally identifiable information, and enhancing insurance agency and dealership efficiency.

Reduced

Compliance Risks

Enhanced Customer Experience

Faster Sales

Process

Integrate Insurance

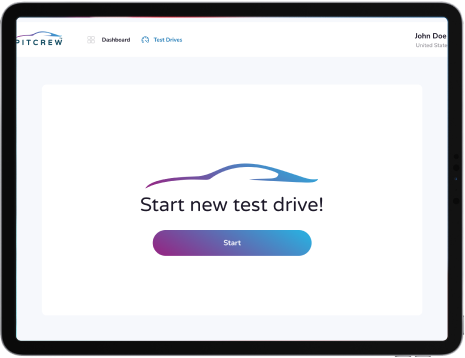

PitCrew Software: Where

Compliance Enables Sales - Pairing Dealerships with Insurance Agencies!

Droplets’ PitCrew software integrates compliance directly into the sales process, creating a streamlined experience that bridges our auto dealership clients with our insurance partners.

- We streamline the experience for customers buying a vehicle and the insurance needed to protect their new asset.

- Create a new revenue stream for auto dealerships in insurance referrals.

- Help bind new policies for insurance agencies with customers that are on-lot, actively buying vehicles in real-time.

Sales reps can earn money by making insurance referrals through PitCrew (in a few clicks), regardless if a policy is issued.

Sales reps can earn money by making insurance referrals through PitCrew (in a few clicks), regardless if a policy is issued.

![]() Each referral that turns into a presented quote earns the sales rep a referral fee from our insurance partners.

Each referral that turns into a presented quote earns the sales rep a referral fee from our insurance partners.

![]()

There is no limit to the number of referrals a sales rep can be compensated for.

![]()

Sales reps have an online account within PitCrew to manage and transfer their referral compensation to their bank account at their convenience.

![]() The program ensures the dealership remains compliant with state regulations and the FTC Safeguards Rule.

The program ensures the dealership remains compliant with state regulations and the FTC Safeguards Rule.

![]() The dealership does not incur any costs for this compliance, as the sales reps are compensated by our Insurance partners.

The dealership does not incur any costs for this compliance, as the sales reps are compensated by our Insurance partners.

![]()

PitCrew, embedded in the sales process, reduces liability exposure. Sales reps are compensated for compliance efforts without impacting your budget.

![]() Sales reps are motivated to keep the dealership in compliance while earning additional income.

Sales reps are motivated to keep the dealership in compliance while earning additional income.

![]() The dealership benefits from a compliant process without additional expenses.

The dealership benefits from a compliant process without additional expenses.

Regulatory Agencies Requiring WISPs

Auto Dealerships & Insurance Agencies

FTC Safeguards Rule

- 16 CFR §314.4 – FEDERAL TRADE COMMISSION (FTC), SAFEGUARDS RULE (All insurance agencies and auto dealerships in the US).

- NATIONAL LEVEL CUSTOMER DATA PROTECTION REGULATIONS.

Insurance Products in New York

- 23 NYCRR §500 – CYBERSECURITY REQUIREMENTS FOR FINANCIAL SERVICES COMPANIES (All NY licensed agencies)

- STATE LEVEL CUSTOMER PROTECTION REGULATIONS IN NEW YORK.

Insurance products states other than NY.

- NAIC MODEL LAW 668 – INSURANCE DATA SECURITY LAW

- STATE LEVEL CUSTOMER DATA PROTECTION REGULATIONS FOR INSURANCE PRODUCTS. CURRENTLY BEING ENACTED IN STATE ACROSS THE US (2025)

New York

We’re proud to announce our official launch in New York, where we’re delivering tailored compliance solutions to meet the evolving demands of the state’s cybersecurity regulations.

With the New York Department of Financial Services (NYDFS) 23 NYCRR 500 updates taking effect through 2025 and the introduction of the New York Data Protection Act (Assembly Bill A8101), our team is focused on helping insurance agencies and financial institutions navigate these changes with confidence. From onboarding agencies into our compliance programs to preparing them for annual certifications and exemption filings, we’re committed to ensuring our clients are fully prepared for both current and upcoming regulatory requirements.

Learn more about Droplets…

Contact Us

We would love to hear from you. Complete the form or give us a ring!